Cherwell Council Tax

Message from Councillor David Hingley

Dear neighbour,

As Leader of Cherwell District Council, I’m pleased to take this opportunity to update you on our recent work, explain your council tax for the coming year, and share how we’re protecting the local services you rely on.

Our vision and new priorities

Cherwell wants to ensure positive, lasting benefits for you and your communities: improving the quality of local housing, expanding economic opportunities, championing the environment, and promoting community leadership. Our commitment goes beyond simply maintaining core services. We are listening to your concerns, finding innovative solutions, and refocusing our work on the things that matter most to you.

Your council tax for 2025 to 2026

To serve you best, we must take responsible financial decisions to ensure the council remains able to provide excellent services and support. Meanwhile, the income we receive is not keeping pace with rising costs.

To meet these challenges, we have thoroughly reviewed every area of our budget and have identified ways to transform how some of our services operate, delivering over £1million in new efficiency savings for the next financial year (2025/26).

On top of these savings, to keep our services at the standards you expect and to meet growing demand, we need to increase our share of council tax by £5 per year for the average Band D property, in line with government assumptions for all districts.

This is the level of increase government assumes we will make when it decides what level of grants we will get. It is a 3.3% increase to the portion of council tax that we set – it helps protect your frontline services and helps us bring about our shared goal of lasting, positive change in our communities.

Where your money goes

After we collect council tax from you, most of it is redistributed to Oxfordshire County Council, Thames Valley Police, and your town or parish council. We only retain the remaining 6.43%, which is used, for example, to:

- Empty your bins and keep your towns and villages tidy

- Deliver your housing and planning services

- Support environmental health

- Provide advice and support for renters

- Offer sports, leisure activities and community safety initiatives

- Attract jobs and investment to your community

Looking forward

We are committed to creating a Cherwell that meets the diverse needs of today while preparing for tomorrow’s challenges and opportunities. Our focus is on delivering positive, lasting improvement for all.

Our Band D council tax increase is less than 10p per week and will help us maintain your services and deliver on our ambitions for all our communities across the district.

On this page, you’ll find more details about how we are delivering exceptional value for money with our small share of the council tax.

With kind regards, Councillor David Hingley, Leader, Cherwell District Council.

Where your money goes

Although you pay your council tax to us, most of it is distributed to Oxfordshire County Council, Thames Valley Police, and your town or parish council.

We use the remaining 6.43 per cent to provide essential services for you and our 149,000 residents. This includes emptying your bins, cleaning the streets, and running your environmental health and planning services.

We also run the housing register, support people who rent their homes, and provide various sports and leisure activities. But that’s not all. We also work to reduce antisocial behaviour and drive investment and business growth in north Oxfordshire.

How Council Tax funds are divided

Your Council Tax bill is made up of several different amounts of money that go to different organisations:

- Cherwell District Council (6.43 per cent)

- Town and parish councils (4.49 per cent)

- Oxfordshire County Council (77.58 per cent)

- Thames Valley Police and Crime Commissioner (11.50 per cent)

Less than 7 per cent of your Council Tax goes to deliver services provided by Cherwell District Council. For a property in band D this is £158.50 per annum.

Where our money comes from

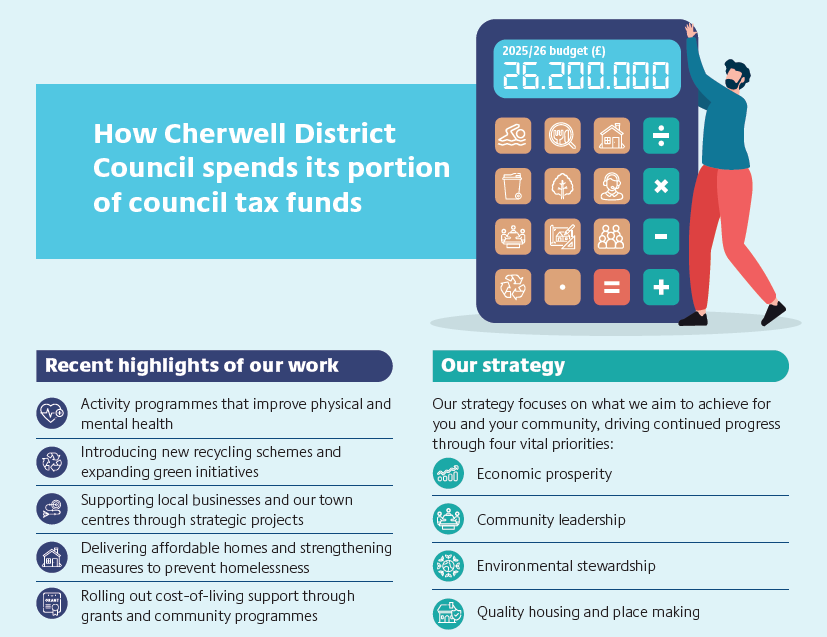

Our budget for 2025-2026 is £26.2m.

Thirty-four per cent of our funding for services comes directly from Council Tax, with the rest coming from government grants and business rates.

- Business rates - £15.0m

- Council Tax - £9.9m

- New Homes Bonus - £0.9m

- Revenue Support Grant - £0.4m

How we spend this budget - our strategic priorities

Council Tax explanatory notes and charges by band for 2025-2026

The Council Tax explanatory notes form part of your Council Tax Demand Notice. Your Council Tax demand or exemption notice shows which band has been allocated to your property.

View Council Tax Charges 2025-2026

Read more about how your Council Tax is calculated.