How your Council Tax is calculated

Cherwell Council Tax charges by band

Your Council Tax demand or exemption notice shows which band has been allocated to your property.

Council Tax charges for 2025-2026

The council tax explanatory notes form part of your Council Tax Demand Notice.

Increase for 2025-2026

The increase to Council Tax was agreed at the Council meeting on Monday 24 February 2025.

Calculation of the tax base: the starting point of the calculation is the total number of Council Tax dwellings and their Council Tax band at a point in time. For 2025-26 this was as at 1 December 2024.

Council Tax in parishes shows how the Band D for each Parish in the district is made up. It starts with the tax base in each Parish, what they have set as their precept (how much they need for the year to provide their services), and how much that works out per property. To that are added the Band D requirements of Cherwell District Council, Oxfordshire County Council, and the Police and Crime Commissioner for Thames Valley to get the full Band D council tax for each Parish.

Council Tax in Band D in each Parish shows the full council tax bandings (A – H) for all Parishes in the district using the weightings prescribed by law.

For example: Adderbury’s Band D council tax is £2,416.16. Band A is 6/9 (66.67 per cent) of the Band D amount or £1,610.78. Band H is 18/9 (200 per cent) of the Band D amount or £4,832.32.

How we spend Council Tax funds

Thirty-eight per cent of our funding for services comes directly from Council Tax, with the rest coming from government grants and business rates. This helps us to provide and support a huge range of services that enhance and improve the lives of people across our whole community.

Our 2025-2026 strategic priorities are:

- Housing that meets your needs

- Supporting environmental sustainability

- An enterprising economy with strong and vibrant local centres

- Healthy, resilient and engaged communities

Your Council Tax bill is made up of several different amounts of money that go to different organisations:

- Cherwell District Council (6.43 per cent)

- Town and parish councils (4.49 per cent)

- Oxfordshire County Council (77.58 per cent)

- Thames Valley Police and Crime Commissioner (11.50 per cent)

Adult Social Care

The government also allows councils (Oxfordshire County Council) to raise up to 2 per cent adult social care precept to help relieve funding pressures in 2025-26.

Calculation of the tax base

The starting point of the calculation is the total number of council tax dwellings and their council tax band at a point in time. For 2025-26 this was as at 1 December 2024.

The council then allows for the following information and estimates for each band:

(a) Dwellings which are exempt, so no council tax is payable (e.g. those where all occupiers are students)

(b) Dwellings which attract a 25 per cent reduction (e.g. those with a single adult occupier)

(c) Dwellings which attract a 50 per cent reduction (e.g. those properties where all adult residents are disregarded or ‘don’t count’ for council tax purposes)

(d) Dwellings which are treated as paying a lower band because they have been adapted for a disabled person. The regulations specify how to adjust the tax base in respect of band A dwellings.

(e) Dwellings which attract a reduction through the Council Tax Reduction Scheme.

(f) Dwellings which are subject to additional charges (e.g. those that have been empty and unfurnished for 1 year and over).

Each band is then converted into “band D equivalents” by applying the factor required by legislation. A band H, for example, is multiplied by two. All of these are added together to give a total number of band D equivalents.

A further adjustment is made for Class O exempt properties (Armed forces’ accommodation) as the Ministry of Defence makes a payment roughly equal to the council tax that it would have had to pay for each property if they were not exempt.

We also estimate the number of properties which will be either added to or removed from the Valuation List in the new financial year and make an adjustment to reflect that they won’t all be subject to full council tax for 12 months.

A final adjustment is made to allow for non-collection. The council is required to decide what its collection rate is likely to be and applies this to its council tax base. For 2024-2025 this was 98 per cent and it continues to be 98 per cent in 2025-2026.

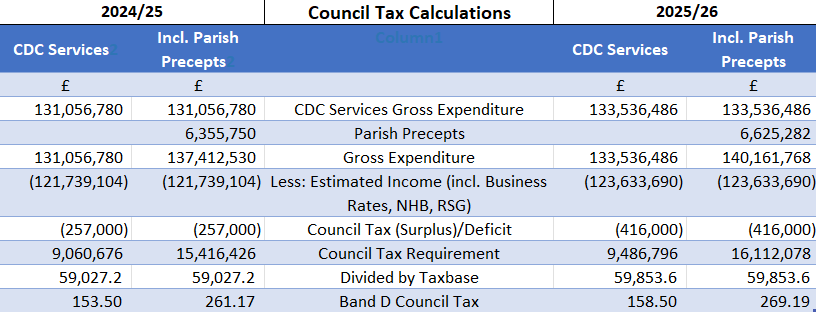

Council Tax calculations : 2024-2025 and 2025-2026

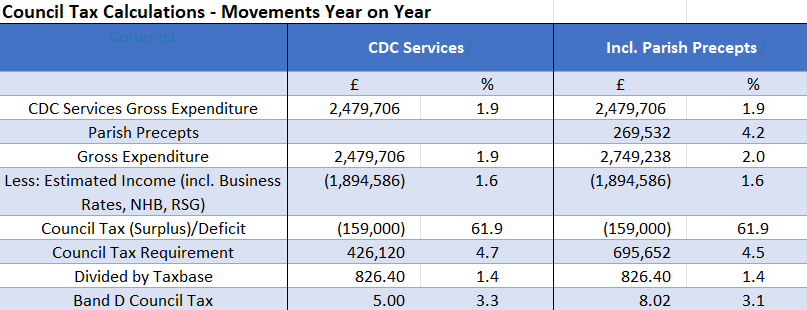

Movements year on year